As hard as it is to start a great company, it’s even harder to exit one.

We’re here to help.

It took thousands of deals to build your company, but only one deal will determine how well you exit.

From strategic planning in anticipation of an acquisition, to finding potential buyers and executing the deal, we make sure your final deal is your best.

We’ve sat on both sides of the table. As buyers. As sellers. And as operators.

You started a great company. But do you know how to stop?

Today, there are more than 34 million small businesses in the US—accounting for 99.9% of all firms.

But what if you’re one of these in-the-trenches SMB founders who has built a successful business and you’re ready to get out? How do you exit your company (read: retire)?

The reality? 66% have no exit plan at all.

Even worse? The tiny 12% who have a concrete plan in place either struggle to sell or sell for too little—leaving critical, hard-earned retirement money on the table.

It turns out that successfully exiting a business (30%) is statistically more difficult than

building a successful business (34.2%; 10 year benchmark).

Our firm exists to help you exit at a winning price—while honoring the non-financial (legacy, employee well-being, values) considerations that matter to you.

Exit Velocity

(n)

•

Exit Velocity (n) •

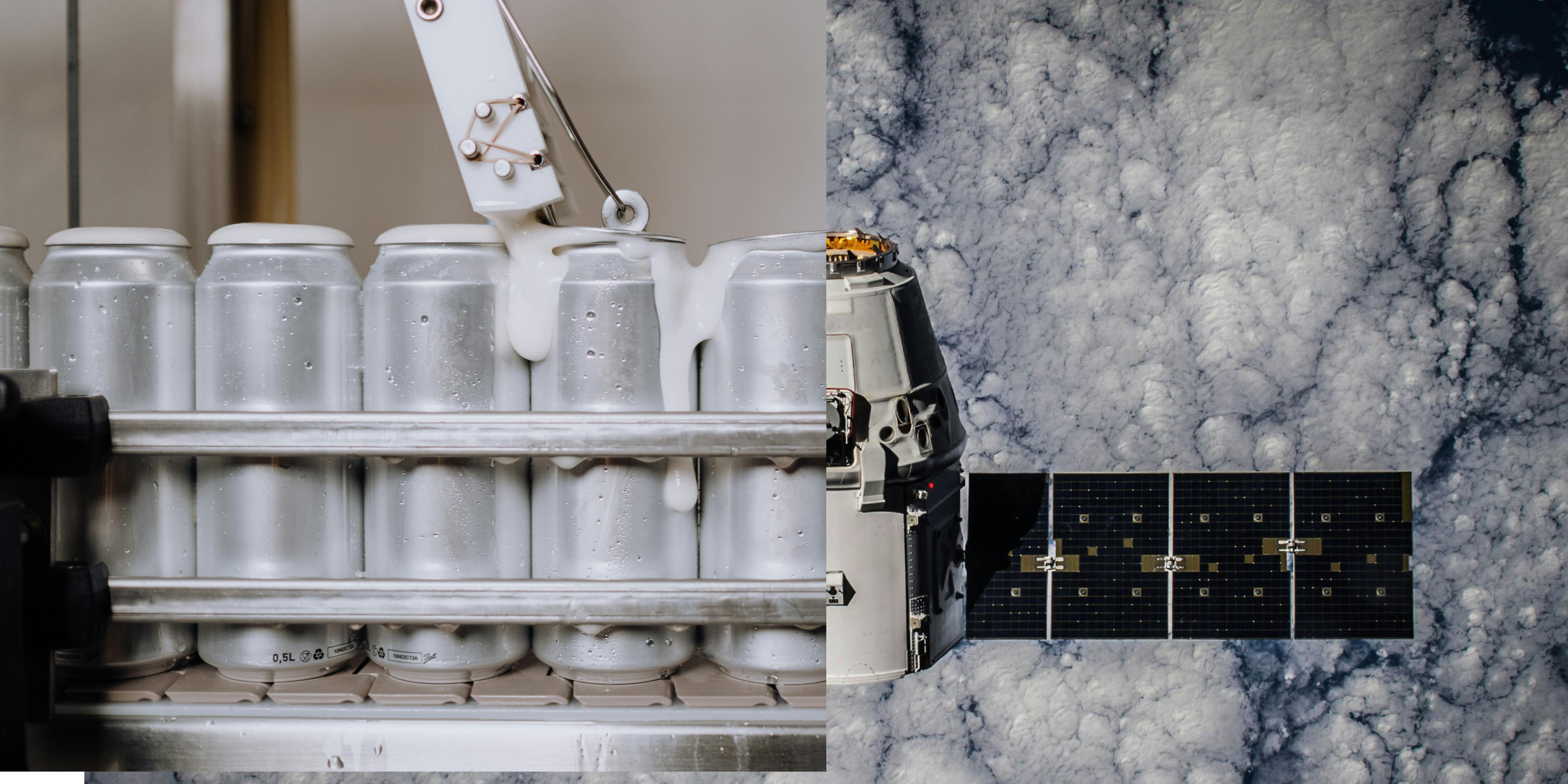

a) in aerospace, the velocity of exhaust gases exiting a rocket or jet engine nozzle—a critical factor in determining whether the vehicle exits the atmosphere or fails to launch

b) in business, the successful exit of a founder/owner through acquisition at the right price, at the right time, in a way that honors the great company that business owner has built

Who We Are

We’ve sat in every seat at the table—as buyers, sellers, & operators.

From Fortune 100 executive to successful startup founder, Jamal has spent over a decade operating and scaling successful teams and products. In addition to being an internationally recognized engineer in AI, he has a masters in business from the Stanford Graduate School of Business and a doctorate in organizational behavior from USC.

Jamal Madni

For 15+ years, Lamiaa has been on the front lines of some of the world’s biggest deals and most successful companies in both Europe and the US, including Apple and private equity firm Ardian. She has a masters degrees in Finance and Business from both the Stanford Graduate School of Business and Université Paris Dauphine.

Lamiaa Daif

With nearly two decades of experience creating some of the world’s most celebrated sales and marketing campaigns (winning a Cannes Lion for his efforts), Matt’s deep expertise lies in hacking consumer behavior, user experience design and product strategy—while also being a successful startup founder and Stanford GSB grad.

Matthew Davis

From Scale…

Often, our clients need a roadmap to optimize their business for the type of exit that they hope for.

In these cases, our team will diagnose and actualize your exit strategy. From revenue acceleration, to process efficiencies, to organizational redesigns, to productivity enhancements, to new market entries, we set up your exit for success—one that aligns with your personal and financial goals.

To

Sale.

When you’re ready to exit, our team takes care of everything. From authoring investment memos, to creating a marketplace of the right buyers, to curating the selection process, to coaching you through due diligence, to negotiating the best terms, we know how to tell the right story ensuring you and your employees win the deal.

EBITDA. CAPEX. COGS.

IYKYK. (And we know).

Selling a business isn’t anything like starting a business—even if you know all the acronyms. And while you’re clearly talented at starting a business, you might be wondering if you could use some experienced help selling that business.

For most SMB owners, the answer is yes.

If you’re considering selling your business, let’s talk.